The world of finance is on the verge of change. Having a big affect on different enterprise sectors, the inventory market serves as an vital mechanism and key issue for corporations to lift capital. With US inventory market property anticipated to develop to $40 trillion in 2023, equal to 1.5 instances the nation’s GDP, it represents a good portion of the general financial system, highlighting its vital place as a benchmark for the American financial panorama.

Two distinguished scientists from South Dakota State College – Kaiqun Fu, an skilled assistant professor within the Division of Electrical Engineering and Pc Science, along with graduate scholar researcher Yanxiao Bai introduced a really attention-grabbing synthetic intelligence mannequin known as “ALERTA-Internet”. This deep neural community features a novel benefit by combining macroeconomic indicators, search engine knowledge and social media context. It raises the query: can AI instruments be the important thing to predicting inventory actions and inventory market volatility? Let’s take a more in-depth have a look at these modern research and their potential affect on the monetary panorama.

Their analysis focuses on blue chip shares, which mirror broader inventory market dynamics. Blue chip shares are shares issued by financially sound, well-established corporations with an impeccable popularity.

The researchers chosen 41 blue chip shares from 10 sectors in response to the International Trade Classification Customary (GICS) to check the monetary market. Every of those shares is taken into account an funding prospect by each Moody’s and S&P. Given the identified difficulties of precisely forecasting inventory costs, scientists have determined to make use of blue chip shares to foretell upcoming inventory value actions and volatility developments.

Two important methodologies prevail in inventory market analysis: technical and basic evaluation. Technical evaluation makes use of earlier inventory costs to foretell future developments. Nonetheless, its heavy reliance on historic knowledge can typically miss sudden market modifications on account of surprising occasions. Assuming a uniformly rational market habits, this technique can typically create a random echo chamber, making buying and selling alerts remoted from the actual financial context.

Basic evaluation, then again, integrates each value traits and exterior info, together with knowledge from social media and search engines like google and yahoo. This strategy demonstrates improved accuracy in forecasting the shut of the S&P 500 Index when integrating Twitter knowledge into its mannequin. Whereas these knowledge sources typically mirror not solely the monetary market but additionally vital financial indicators, the predominant analysis in basic evaluation tends to emphasise the monetary market, neglecting the symbiotic relationship between the general financial system and the inventory market. Furthermore, present fashions primarily deal with predicting shifts in developments, typically neglecting the significance of the size of those modifications. However within the space of inventory habits, the size of those shifts is important.

Of their article, revealed on the arXiv preprint server, the researchers suggest a brand new mannequin that mixes each approaches. ALERTA-Internet – Attentional TemporaL DistancE AwaRe RecurrenT NeurAl Networks. The proposed framework permits combining knowledge from social networks, macroeconomic indicators and knowledge from search engines like google and yahoo to foretell inventory value actions and volatility.

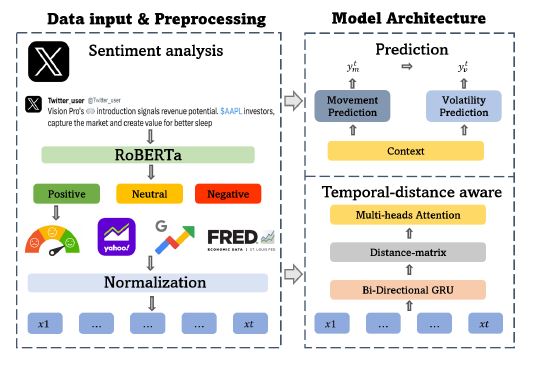

Let’s contemplate the final structure of ALERTA-Internet. The info enter and preprocessing layer converts each temporal and textual info into dense vectors. Then, the distance-aware temporal layer has a recurrent illustration that identifies hidden dependencies in present inventory knowledge based mostly on previous info. The space matrix context then integrates these historic dependencies right into a sequence of options. And eventually, the forecast layer generates time-adjusted inventory motion and volatility forecasts for the following time interval, thereby offering a whole and coherent system for inventory forecasting.

The ALERTA-Internet structure is designed to foretell the motion and volatility on day t. The info enter and preprocessing part extracts textual info from Twitter and converts it into sentiment scores. ALERTA-Internet then makes use of these sentiment scores together with different options to make predictions based mostly on temporal distance.

So as to validate the effectiveness of the proposed mannequin, experiments and comparisons had been carried out on one actual dataset. The dataset offers sentiment scores for 41 blue chip shares and combines three important parts: value knowledge, Twitter sentiment knowledge, and macroeconomic knowledge.

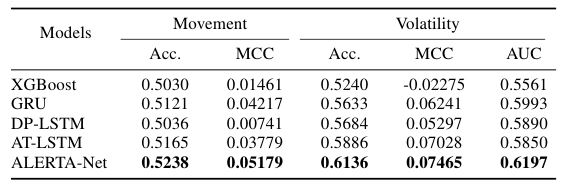

The efficiency of ALERTA-Internet was evaluated by comparability with DP-LSTM, a widely known inventory motion prediction community based mostly on monetary knowledge. Different benchmarks used within the research embrace Excessive Gradient Boosting, attention-based LSTM, and GRU. The outcomes are outlined by way of accuracy and Matthews Correlation Coefficient. On condition that knowledge factors involving inventory value modifications of greater than 5% constituted solely a small portion of the dataset, it was determined to make use of the realm beneath the ROC curve (AUC) as a efficiency measure to realize a extra dependable and sensible forecast. The outcomes are proven within the desk beneath.

With ALERTA-Internet, it turns into attainable not solely to foretell inventory value actions, but additionally to successfully receive details about inventory market volatility. This lets you anticipate any uncommon fluctuations within the inventory market sooner or later.

ALERTA-Internet has confirmed itself in recognizing dynamic, temporal, distance relationships embedded in numerous hidden states. Through the use of same-day inventory value actions, the mannequin considerably will increase its accuracy in predicting inventory market volatility.

General, ALERTA-Internet, a deep generative neural community structure, has demonstrated the effectiveness of mixing search engine knowledge, macroeconomic indicators, and social media knowledge in trying to forecast inventory actions and volatility. In future research, the researchers plan to enhance accuracy by integrating a number of textual content and audio sources, together with earnings calls and monetary statements.