Moving into the world of inventory buying and selling can really feel like attempting to pilot a spaceship and not using a guide—particularly whenever you hear issues like “algorithms,” “quantitative indicators,” or “neural networks.” However what if I advised you that you should use AI-powered buying and selling bots—with out writing a single line of code—and nonetheless really feel such as you’re flying the factor?

Whether or not you’re a complete newbie or somebody who simply doesn’t fancy spreadsheets and scripts, there’s a brand new breed of AI buying and selling instruments designed precisely for folks like us: no coders, curious minds, and informal merchants.

Let’s break down what this complete AI inventory buying and selling bot factor is about, the way it might help you, and which of them are literally price your consideration.

Why AI Buying and selling Bots Are a Large Deal (Particularly for Newbies)

Inventory markets are emotional. Satirically, the neatest buying and selling choices come from not being emotional. That’s the place AI steps in. These bots analyse hundreds of information factors quicker than your human mind can blink—worth traits, quantity adjustments, information sentiment, insider exercise—all processed with out the concern, greed, or guesswork.

However right here’s the magic: no-code AI buying and selling bots allow you to faucet into this good tech with out having to be taught Python or arrange your individual server. You simply plug in your preferences, tweak a couple of sliders, and let the algorithm do the heavy lifting. Consider it as hiring a robo-analyst who works 24/7 and by no means asks for espresso breaks.

⬇️ See the highest AI buying and selling bots

What to Look For in a No-Code AI Buying and selling Bot

Let’s not get scammed by slick interfaces. Right here’s what you need:

- Pre-built Methods: Are there templates you should use out of the field?

- Backtesting: Are you able to check methods on historic knowledge earlier than risking actual cash?

- Transparency: Does the platform clarify how its AI works, or is it simply black-box magic?

- Integration: Does it hook up with your dealer (Robinhood, Coinbase, Binance, and many others.)?

- Consumer Interface: Can your grandma use it? If not, rethink.

Frequent Use Circumstances (and Actual-Life Vibes)

- You’re a newbie who needs to “autopilot” inventory buying and selling whereas studying.

- You’re employed full-time and might’t stare at charts all day.

- You’re uninterested in meme shares and need one thing data-driven.

- You need diversification between crypto, shares, and foreign exchange.

Should you’re nodding alongside to any of those, the bots we’re about to debate may simply be your new buying and selling BFFs.

Desk of Contents – Greatest AI Inventory Buying and selling Bots (No Code)

What’s it?

Aterna AI is just like the considering dealer’s AI assistant. It’s constructed for individuals who need AI that feels much less robotic and extra intuitive—like a buying and selling mentor that speaks your language.

Key Options

- Technique era based mostly on conversational enter

- Customized portfolio threat profiles

- Commerce rationalization layer—why it’s taking motion

- Lengthy/brief equity-focused with occasional crypto strategies

Use Circumstances

Good for individuals who wish to perceive why a commerce is made, not simply comply with blindly. Should you’re constructing confidence and wish to develop together with your bot, Aterna’s “explainability” offers you peace of thoughts.

My Verdict

It’s a bit like having a intelligent pal whispering market ideas in your ear. Enormous win when you’re each curious and cautious.

What’s it?

Tickeron scans markets for technical patterns, insider exercise, and information sentiment—then serves up commerce concepts on a silver platter.

Key Options

- AI sample search engine (hi there, flags, triangles, wedges)

- Backtested commerce indicators

- Prediction Confidence Rankings (good contact!)

- Market for professional methods

Use Circumstances

Nice for people who wish to be taught technical evaluation alongside the best way. You’ll be able to see how patterns result in trades and tweak them on your personal wants.

My Verdict

Visible learners, this one’s for you. The prediction graphs are borderline addictive.

What’s it?

Consider Intellectia as a knowledge geek that loves you. It focuses closely on AI-powered market forecasts, supplying you with possibilities slightly than obscure “purchase” strategies.

Key Options

- Predictive fashions on equities and ETFs

- Dynamic sign era

- Portfolio rebalance instruments

- Consumer-friendly dashboards

Use Circumstances

Ultimate for technique nerds who don’t wish to code however nonetheless love forecasting fashions and threat assessments.

My Verdict

It’s the AI bot for knowledge romantics—when you love patterns, charts, and numbers, Intellectia will flirt together with your inside quant.

What’s it?

Not simply a charting platform—TradingView now integrates AI-based sign bots and third-party scripts you should use or clone.

Key Options

- Huge group of script-sharing merchants

- Pine Script editor (elective)

- Alerts, sign bots, and integrations with brokers

- Stunning UI that makes you’re feeling good even whenever you’re not

Use Circumstances

Good for DIY merchants who need full management but additionally the choice to repeat smarter folks. No-code customers can use shared methods with out touching code.

My Verdict

It’s like Reddit + Bloomberg + Excel on steroids. Should you wish to be taught socially, go right here.

What’s it?

Coinrule is a Lego package for buying and selling methods. “If this, then that” however for shares and crypto.

Key Options

- Drag-and-drop rule builder

- Pre-built templates for momentum, RSI, MA crossover

- Backtesting engine

- Connects to brokers like Binance, Coinbase, and a few inventory APIs

Use Circumstances

For tinkerers who like management however hate code. You’ll love how straightforward it’s to check “what if” situations.

My Verdict

Truthfully? One of the crucial satisfying UIs on the market. It’s the AI bot for inventive thinkers.

What’s it?

Kavout makes use of machine studying and massive knowledge to rank shares utilizing its “Kai Rating”—a mix of fundamentals, momentum, and worth motion.

Key Options

- Kai Rating for equities

- Portfolio modeling instruments

- Information-driven insights with minimal fluff

- Integrates with hedge fund-level knowledge

Use Circumstances

You need rankings, not guidelines. Simply inform me what the highest shares are, please.

My Verdict

Should you’re a “simply inform me the perfect” form of dealer, Kavout hits that candy spot.

What’s it?

TradeIdeas is like caffeine for merchants. It’s fast, loud, and good. Their AI, “Holly,” scans stay markets and delivers methods.

Key Options

- Actual-time thought scanner

- AI fashions that check hundreds of methods

- Brokerage integration

- Paper buying and selling mode

Use Circumstances

Made for quick movers—day merchants, scalpers, and market junkies.

My Verdict

Should you get a rush from tick-by-tick motion, this one’s your spirit bot.

What’s it?

Initially a crypto bot, TradeSanta now helps a couple of conventional property and presents straightforward automation.

Key Options

- Grid and DCA methods

- Multi-exchange help

- Easy interface

- Market of bot templates

Use Circumstances

Crypto-first merchants who wish to strive their hand at shares with out leaping to a brand new platform.

My Verdict

Slick and easy. Like if Coinbase made a bot—user-friendly to the bone.

What’s it?

Bitsgap connects a number of exchanges, supplying you with a single management panel for all of your buying and selling bots.

Key Options

- Unified dashboard

- AI-powered bots (grid, arbitrage)

- Backtesting

- Helps crypto, foreign exchange, and indices

Use Circumstances

For folks juggling accounts on a number of exchanges—nice for each crypto and conventional merchants.

My Verdict

In case your tabs are at all times overflowing, you want Bitsgap’s all-in-one view.

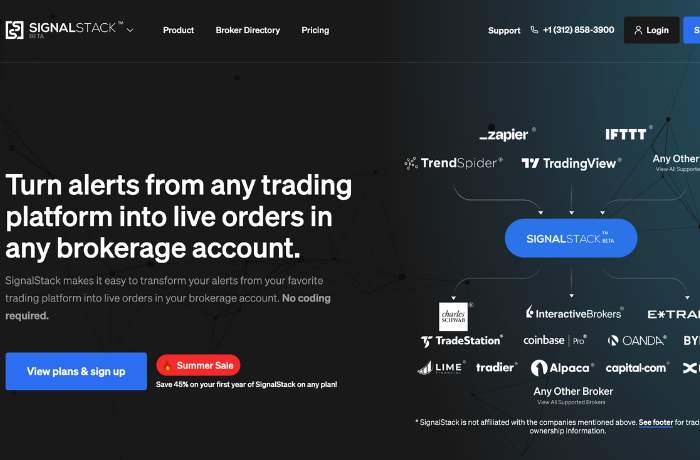

What’s it?

Sign Stack isn’t a bot itself—however it helps you to automate indicators out of your favorite instruments (like newsletters, TradingView alerts, and many others.).

Key Options

- Converts alerts into trades routinely

- Works with brokers and exchanges

- No code setup

- Webhook-based logic

Use Circumstances

Good for e-newsletter junkies or group sign followers—you get alerts, and Sign Stack locations the trades for you.

My Verdict

It’s automation glue. Good when you already know what you wish to commerce however don’t wish to babysit your display.

Ultimate Ideas & Prime 3 Picks

After diving headfirst into these platforms, right here’s how I’d sum it up:

🏆 Greatest Total – Coinrule

The right mixture of energy and ease-of-use. You’ll be able to construct, check, and launch methods with out feeling such as you’re debugging a nuclear reactor.

🔍 Greatest for Studying – Aterna AI

If you wish to perceive what’s occurring and develop your expertise, Aterna makes AI explainable—and that’s price gold for newbies.

⚡ Greatest for Quick-Movers – TradeIdeas

For the adrenaline merchants, nothing comes shut. Actual-time scans, AI-driven picks, and momentum alerts that preserve your pulse racing.