A brand new phishing rip-off is leveraging PayPal’s reliable bill system to trick unsuspecting customers, even showing with the coveted “blue tick” verification mark of their inboxes. This refined assault is bypassing conventional electronic mail safety filters and leaving even tech-savvy people confused.

Hackread.com has obtained direct proof of this escalating risk, confirming that attackers are exploiting PayPal’s personal providers to ship fraudulent cash requests, making them seem totally genuine.

The Deception: Why the Blue Tick is a Lie

You’ve been taught to search for crimson flags: spelling errors, suspicious hyperlinks, and unverified senders. However this rip-off exploits belief. Earlier at this time, one among our crew members at Hackread.com acquired an bill electronic mail with a PayPal blue tick, addressed to a very unknown electronic mail: [email protected].” It regarded utterly reliable, straight from [email protected], however the content material was clearly malicious.

Right here’s how this “no-phish” phish works:

- Respectable Supply: Scammers create a reliable (albeit fraudulent) enterprise account on PayPal.

- Actual Invoices: They use PayPal’s precise “Cash Request” or “Bill” characteristic. As a result of PayPal itself is sending the e-mail, it passes all authentication checks (SPF, DKIM, DMARC) and earns the “blue tick” (Model Indicators for Message Identification – BIMI) in your inbox. On this case, the e-mail bypassed the safety filters supplied by Google Workspace.

- The Hidden Entice: The precise rip-off isn’t in a malicious hyperlink (although a hyperlink to a reliable PayPal bill is current). As an alternative, it’s within the “Be aware to Buyer” part of the bill. Right here, scammers insert their messages like: “Your account has been charged $843.29, if you happen to didn’t approve this, Contact Assist

+1-805-400-3162.”

- The Fallacious Recipient Trick: By addressing the e-mail to an obscure or group electronic mail tackle (like

[email protected]), the attackers intention to confuse recipients. Customers usually suppose, “This isn’t for me, but it surely’s from PayPal… one thing is fallacious!” This confusion is designed to make you name the fraudulent cellphone quantity.

The Actual Hazard: Name-Again Phishing

This can be a easy callback phishing assault. The FBI has issued a number of warnings about this tactic. The cellphone quantity supplied within the bill observe does NOT belong to PayPal. It connects on to a rip-off name heart. As soon as on the cellphone, the scammers will make use of social engineering techniques to:

- Achieve distant entry to your pc (e.g., asking you to put in “AnyDesk” or “TeamViewer”).

- Trick you into logging into your checking account or different delicate monetary platforms.

- “Assist” you reverse the fraudulent cost, usually by making you imagine you by chance transferred an excessive amount of cash, main them to demand you ship them a reimbursement.

What You MUST Do to Keep Secure:

- DO NOT Name Any Quantity within the Electronic mail: That is the first entice. PayPal won’t ever ask you to name a quantity from an bill observe.

- DO NOT Click on Any Hyperlinks within the Electronic mail (Even when they give the impression of being actual): Whereas the hyperlink may go to an actual PayPal bill, participating with it could possibly nonetheless result in confusion.

- Entry PayPal Straight: In case you obtain such an electronic mail, instantly open your internet browser, kind

www.paypal.commanually, and log into your account.

- Examine for Pending Requests: Search for any sudden “Cash Requests” or “Invoices” in your PayPal exercise. In case you discover the fraudulent one, don’t pay it.

- Report the Fraud: On the reliable PayPal web site, you possibly can often “Cancel” or “Report” the bill straight. You also needs to ahead the rip-off electronic mail (as an attachment if doable) to PayPal’s phishing crew:

[email protected].

- Educate Others: Warn your folks, household, and colleagues about this evolving risk. The “blue tick” is now not a assured signal of security.

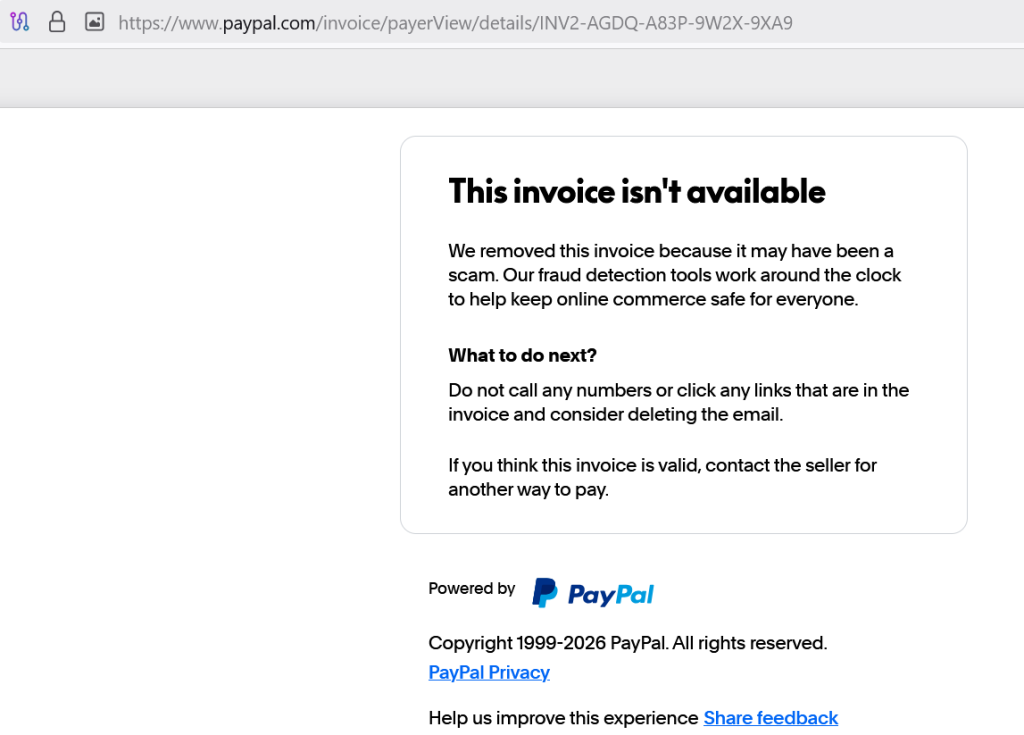

PayPal Acted Rapidly

Hackread.com reported the incident to PayPal, which responded inside hours by eradicating the bill and changing its content material with a rip-off warning: “We eliminated this bill as a result of it might have been a rip-off. Our fraud detection instruments work across the clock to assist hold on-line commerce secure for everybody.”

But, this rip-off goes on to indicate a rising development the place attackers are discovering methods to make use of reliable platforms and providers to ship their malicious payloads. Due to this fact, belief your instincts, and all the time confirm info by way of official channels, by no means by clicking hyperlinks or calling numbers from sudden emails.