You join TradeSanta pondering it’s simply one other bot—however inside minutes you’re constructing grid or DCA bots, tweaking indicators, and truly launching reside bots. That onboarding thrill hits quick. One reviewer mentioned they’d two bots making revenue inside 5 minutes of sign-up—even with zero expertise. That’s the sort of momentum that hooks you quick.

What TradeSanta Is and Isn’t

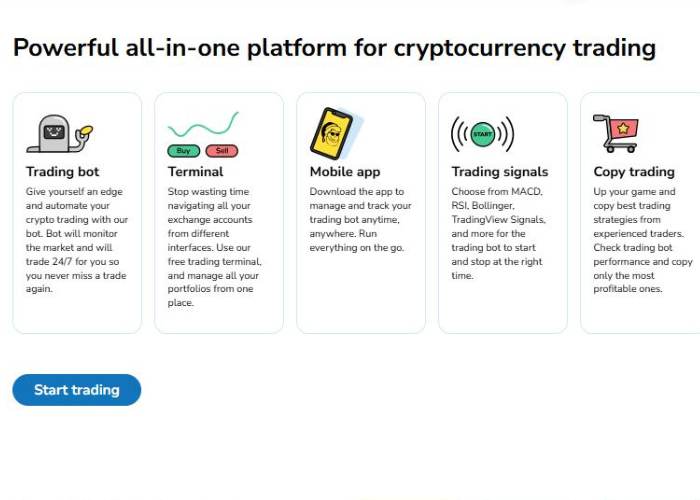

TradeSanta payments itself as a cloud-based crypto bot platform—supporting main exchanges like Binance, Coinbase Professional, Huobi, OKX, HitBTC, Upbit. You construct bots utilizing templates (Grid, DCA, Futures) or set parameters manually. Indicators like RSI, MACD, Bollinger Bands, trailing take revenue, cease loss are all configurable in a no-code interface. It’s not “AI‑pushed” within the machine-learning sense, extra like good rule automation, nevertheless it lives as much as its “automated crypto buying and selling” billing properly.

How My Testing Went… in Jumps

Morning 1: Constructed a grid bot on ETH/BTC pair after studying a tutorial. Fired it in demo mode first. Felt like a professional.

Day 2: Promoted the rule reside. First few trades bought stopped out. Took that as market instructing me a lesson.

Day 3: Tried the DCA futures bot—surprisingly a small revenue got here by means of in a single day. Felt redeeming.

Day 4: I examined Copy Buying and selling: picked a shared technique from neighborhood market and let it run. Suggestions got here in Telegram—alerts and standing. Human contact.

All through: Hit a snag with a stale grid parameter—reached out to “Santa’s Helpers.” Help answered rapidly. Friendlier than anticipated.

What You Really Get

| Function | Description | My Impression |

| Grid Bot | Buys and sells inside value zones | Easy, efficient in range-bound markets |

| DCA Bot | Averages purchase entries to scale back threat | Stable for dips—however thoughts the entry cadence |

| Futures Bot | Permits leveraged automated execution | Provides energy—but additionally threat (begin small) |

| Copy Buying and selling | Mirror seasoned consumer methods from Market | Good studying software and shortcut to deploy examined logic |

| Cease Loss / Trailing | Handle threat routinely | Key safeguard that mitigated early losses |

| Demo mode | Digital testing with out actual funds | Helpful to bootstrap studying—however misses slippage realism |

| Alternate Help | Binance, Coinbase Professional, Huobi, OKX, HitBTC, Upbit | Covers main markets although nonetheless restricted to ~8 |

Professionals and Cons—In Plain Fact

What’s Good:

- Units up bots in minutes—templates minimize the confusion.

- Demo mode helps you take a look at earlier than risking.

- Helps futures bots on increased plans.

- Copy buying and selling and market ease entry.

- Responsive assist, strong neighborhood suggestions.

- Inexpensive plans beginning ~$14–20/month, limitless bots on Most plan.

What Falls Brief:

- Solely fundamental indicators; lacks AI optimization instruments.

- Demo mode doesn’t simulate slippage or charges realistically.

- Free trial simply three days—not sufficient time to discover all bots.

- System lag reported throughout elevated quantity can value mis-executions.

- No built-in portfolio evaluation or threat scoring like some rivals.

The Emotional Rollercoaster

Day one: pumped, constructing a grid bot. Felt the fun.

Day two: braced for losses; cease‑loss hit quick. That gut-punch of errors realized the arduous method.

Day three: small revenue from DCA rule. That gave hope—a reminder automation can work.

Blended in: slight frustration when alerts missed a fill due to API latency. It jogged my memory: bots aren’t magic. They’re instruments—you continue to want verification.

Group narrative matches mine—customers say “gained’t make you wealthy in a single day” however for ~$20/month it’s definitely worth the setup.

Pricing Snapshot

| Plan | Month-to-month Price | Options |

| Primary | Free or ~$0 | Demo bots, restricted lively bot depend, delayed information |

| Superior | ~$20/mo | Stay bots, as much as ~50 bots, fundamental indicators |

| Most | ~$70/mo | Limitless bots, copy-trade, full futures assist |

Be aware: TradeSanta doesn’t cost maker/taker charges themselves, however change charges nonetheless apply. There’s no free without end tier past demo.

Who Ought to Use It?

- Merchants new to automation who need easy no-code setup

- Individuals who desire drag‑and‑drop bots over scripting

- Novices inquisitive about grid, DCA, futures bots

- Those that need minimal upkeep after setup

Not preferrred for these anticipating full AI-driven optimization or portfolio-level oversight—or high-frequency execution merchants needing ultra-low latency.

Options for Enchancment

- Lengthen free trial to 7–14 days so newbies can discover options slower.

- Add actual market slippage simulation to demo mode

- Increase supported exchanges past eight main ones

- Provide extra superior indicators and AI-based technique instruments

- Higher transparency on missed fills or system capability alerts

Last Take (My Private Opinion)

TradeSanta is what I’d name a “crypto bot engine-lite”: simple to spin up bots, useful market, strong assist—however no fancy AI modeling or predictive analytics. It doesn’t assure revenue, nevertheless it automates methods reliably if what you’re doing.

In the event you’re getting began, the intuitive interface and low value assist you take a look at the waters safely. In the event you’re extra superior, it offers you versatile bots and futures choices—however ultimately you’ll outgrow its restricted indicators and manual-heavy design.

Attempt the demo, run a few bots with small capital, and see if the efficiency feels affordable. If sure, scale slowly. If it clicks—nice. If not, don’t blame the software for dangerous guidelines.

Need assistance designing a grid bot setup or risk-managed DCA rule? I’m completely satisfied to stroll by means of actual parameter examples or rule concepts.